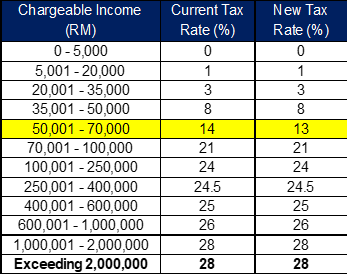

All forms of earnings are generally taxable and fall under the personal income tax bracket. Personal income tax rates.

Tiffin Sentul Depot Satisfy Your Seafood Cravings At The Big Feast By Tiffin At The Yard

Taxable Income MYR Tax.

. 40000 can be claimed by an. As per the grade you are selected for there can be a mild variation in the salary. Let us understand the salary package and the incentives earned by an Income Tax.

Intuit will assign you a tax expert based on availability. The starting salary of the SSC CGL Income Tax Inspector and Income Tax Officer is somewhere around 44900 INR along with a grade pay that ranges somewhere between 4000-5500 INR. This is the income tax guide for the year of assessment 2019If you are filing your taxes in 2021 then head on over to our income tax guide for YA2020 here.

The tax brackets are determined for one year in advance. The provisions for income tax exemptions are created to meet the need of the concerned people across the country. The Tax Tables list income in 50 increments for all categories of taxpayers single married filing jointly married filing separately and head of household.

Taxable capital gains 40 of the sum of realised gains less capital losses and annual exclusion Equals. Resident Vs Non Resident. Marginal Tax Rate US.

The law stipulates that anyone who resides in Thailand for longer than 180 days is. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Jim Justices income tax proposal but ultimately kept the governors plan intact Thursday.

The amount you pay depends on the amount you withdraw and where you live. This ranges from a work salary to capital gains or dividends lease transactions or even selling clothes on the sidewalk as long as the earnings are over 150k per year. The Income-tax Act of India has a number of sections that taxpayers can use to reduce their taxes.

Section 80DDB is one of the most important sub-sections of the Income Tax Act as it helps the individual to tide over their concerns against the treatment of the critical disease. The Tax Tables are in the 2007 1040 Instructions. Malaysia Income Tax Brackets and Other Information.

Gross income ie. Based on the income tax. Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2022.

For 2022 tax year. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Read more are bifurcated into seven brackets based on their taxable income.

This maximum investment amount is decided by the government. The domestic tax systems in the world may be grouped into eight broad families of income tax laws. Tax Advice Expert Review and TurboTax Live.

In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. Withdrawing between 5001 and 15000 means the withholding tax rate is 20. However every section amongst these has a pre-set maximum investment amount.

Tax rates range from 0 to 30. Taking 5000 means the withholding tax rate is 10. For the Taxable Income.

Taxable base EUR Tax on column 1 EUR Tax on excess Over column 1 Not over. If you take money from your RRSP the government will charge a withholding tax. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount.

The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D. CPA availability may be limited. The deductions of Rs.

Total receipts and accruals less receipts and accruals of a capital nature Less. The tax on the Taxable Income is found in a Tax Table if the Taxable Income is less than 100000 and is computed if over 100000. In 2022 the following tax brackets and tax rates are applicable in line with the recent amendments of the PIT Act.

Income tax season has arrived in Malaysia so lets see how ready you are to file your taxes. Under these systems certain countries have a single tax system for all taxpayers global system while other countries provide separate tax laws for different taxpayers and different items of income scheduler system. PIT is calculated considering five tax brackets.

Tax rate according to the tax bracket. Many of them follow a hybrid system which contains. CHARLESTON Members of the West Virginia House of Delegates determined they could stray from Gov.

Youll have to pay tax on your RRSP withdrawals.

Malaysia Budget 2021 Personal Income Tax Goodies

Malaysian Tax Issues For Expats Activpayroll

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Cukai Pendapatan How To File Income Tax In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Income Tax Malaysia Income Tax

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

10 Things To Know For Filing Income Tax In 2019 Mypf My

Tax Guide For Expats In Malaysia Expatgo

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Budget Highlight 2021 Taxletter 26 Anc Group

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done Stocknews

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia